What to do with a profitable option position? We look at (UNH), (AVGO), and (ORCL) positions

Trading options is not as simple as executing and waiting til expiry. There are many steps investors can take pre-expiry, to either realise profits, limit losses or roll exposure.

Three recent strategies we posted are all expiring within the next few days to a week.

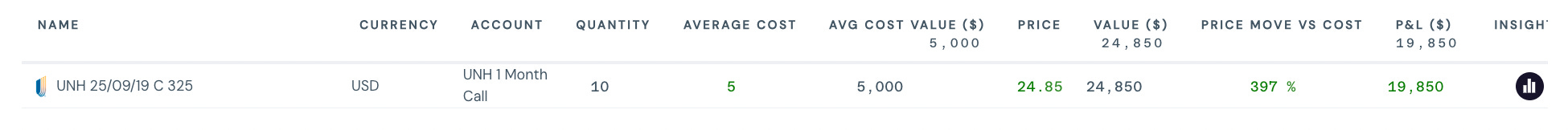

United HealthGroup (UNH) 19th September 1-Month Call - What do Buffett, Appaloosa, Dr. Burry, Platt and Soros have in common?

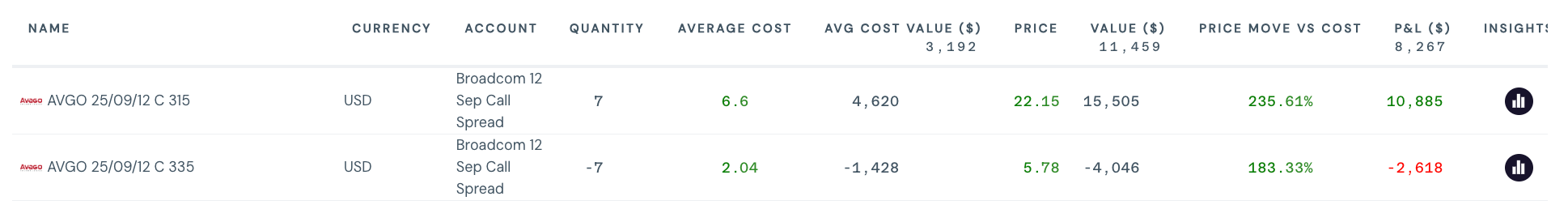

Broadcom (AVGO) 12th Sep Call Spread - Want to play Broadcom earnings (AVGO) ?

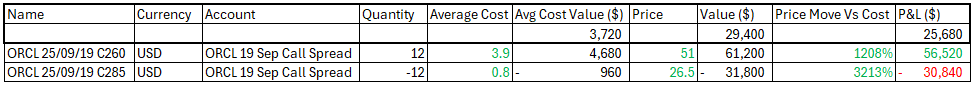

Oracle (ORCL) 19th Sep Call Spread - Can Oracle earnings surprise again (last time the stock was +22% in 2 days)?

All of these strategies are currently in the money.

*Oracle position reflects the after-market price move to $311.00, using estimated option prices

‘Nobody ever went broke taking a profit’ is an old idiom that highlights how sometimes greed isn’t the best option; in fact, taking early profits can be a prudent decision. If an existing call spread can realise a similar profit now as its maximum at expiry, it’s often better to take the profit rather than risk a price decrease over the next few days.

From this point, investors have several choices, all dependent on their outlook for the stock and the level of involvement they desire

Exit Position

Rationale: An investor can close out either of these positions for a profit, content with the investment and happy not to participate in any future downside or potential upside.

This can often seem like a straightforward decision, but with the strategy so close to expiry, holding out to maximise profits becomes all the more tempting.

UnitedHealth Group (UNH): One can potentially sell the 19 Sep 325 Call for around $24.85, which is almost 5x return on the initial cost, locking in a healthy profit of almost $20.00 per contract. As its a naked call, all possibilities are viable depending on the view. Read on for other possibilities.

Broadcom (AVGO): The max profit is $20. If the position is unwound at current prices then we will achieve around $16.37. With AVGO trading at $336.67, it is just above the upper call strike of $335. The reason we are not getting the full $20 is that between now and Sep19, the market is pricing in a chance that AVGO drops. As we approach Sep 19, and if AVGO remains above $335, then we will get closer to realizing the full $20.

Oracle (ORCL): The max profit is $25. With Oracle indicating a pre-market price of $311.00, the call spread could be priced very close to the maximum profit level. The risk here is that ORCL drops back to near the $265 level. There is little more to be gained from holding onto the call spread, so in order to mitigate any further risk, we could consider unwinding this call spread.

Roll Options

Rationale: An investor can close out their positions for a profit, but if they still wish to participate in any future upside, they have the choice to roll their options using profits they have received on the stock.

United Healthcare (UNH): Spot is $347.92.

If we are not exiting the position, and think UNH still has more to rally, we can consider rolling the position, which involves banking some of the profits and buying into a new position.

Option 1: Roll into Oct 17 Call spread for a 3.39x multiple

Leg 1: Sell the existing Sep 19 325 Call for $24.85

Leg 2: Buy Oct 17 360 Call for $13.10

Leg 3: Sell Oct 17 380 Call for $7.20

By rolling, we bank $18.95.

Total Cost of the new call spread is $5.90, or 1.7% of the current stock price.

Maximum loss: Equal to the net value of the call spread, $5.90.

Breakeven: $365.90, or 5.2% above the current stock price.

Ideal Outcome: Stock rallies to the strike of the second call ($380), so we realise the full multiple (3.39x).

Broadcom & Oracle

It could be better to let prices settle after a bout of volatility before executing a new strategy—unless the goal is to profit from a potential decrease in volatility. Follow us to learn more about future trading strategies in Broadcom (AVGO) and Oracle (ORCL).

Leave to expiry

The final option for investors is to hold until expiry. If the call options remain in the money, the payoff will be equal to the stock price less the strike price. While there is a chance that the UNH option could continue to rise during the next week, there is the risk that the price may decrease and investors must be willing to accept this.

For call spreads, investors should remain mindful of breakeven prices, but also maximum profits. If Broadcom or Oracle declined substantially over the next few days, it is possible that the maximum profit will not be realised.

Bye for now.

(Prices are based on the previous day’s closing prices and may not reflect the current price.)

By reading, following or subscribing up you have agreed to our disclaimer - Disclaimer

Discloser - Collaborators of our Substack could have holdings or positions in one or several related strategies.